How Eb5 Investment Immigration can Save You Time, Stress, and Money.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

Blog Article

Some Of Eb5 Investment Immigration

Table of ContentsSome Known Incorrect Statements About Eb5 Investment Immigration Not known Factual Statements About Eb5 Investment Immigration Fascination About Eb5 Investment ImmigrationThe Single Strategy To Use For Eb5 Investment ImmigrationSome Ideas on Eb5 Investment Immigration You Should Know

While we make every effort to offer precise and current content, it must not be taken into consideration legal advice. Immigration legislations and regulations are subject to alter, and specific situations can vary commonly. For personalized assistance and legal advice concerning your specific migration situation, we strongly advise seeking advice from a certified migration lawyer who can offer you with tailored help and make sure conformity with present regulations and laws.

Citizenship, via investment. Presently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Locations and Rural Locations) and $1,050,000 elsewhere (non-TEA areas). Congress has actually authorized these quantities for the next five years starting March 15, 2022.

To certify for the EB-5 Visa, Investors need to develop 10 full-time united state tasks within 2 years from the day of their full investment. EB5 Investment Immigration. This EB-5 Visa Need makes sure that financial investments contribute directly to the united state work market. This uses whether the work are created directly by the business business or indirectly under sponsorship of a marked EB-5 Regional Center like EB5 United

Facts About Eb5 Investment Immigration Revealed

These work are identified with designs that make use of inputs such as growth prices (e.g., building and devices costs) or annual profits produced by continuous operations. On the other hand, under the standalone, or direct, EB-5 Program, only direct, full-time W-2 employee placements within the business venture might be counted. A key risk of relying only on direct staff members is that team decreases as a result of market problems might lead to inadequate full time positions, possibly bring about USCIS rejection of the financier's petition if the job production need is not satisfied.

The financial version after that projects the number of direct jobs the new company is likely to create based on its anticipated revenues. Indirect jobs calculated via financial versions describes work created in industries that supply the products or solutions to the business straight entailed in the job. These work are produced as a result of the enhanced demand for items, products, or services that support the business's procedures.

Some Known Details About Eb5 Investment Immigration

An employment-based 5th choice classification (EB-5) investment visa supplies an approach of ending up being an irreversible U.S. homeowner for foreign nationals really hoping to invest resources in the United States. In order to get this permit, a foreign investor needs to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and produce or maintain a minimum of 10 full time jobs for United States employees (leaving out the investor and their prompt family).

This step has actually been an incredible success. Today, 95% of all EB-5 capital is increased and spent by Regional Centers. Because the 2008 economic dilemma, accessibility to capital has been tightened and community spending plans remain to encounter significant deficiencies. In several areas, EB-5 financial investments have actually filled the funding gap, giving a new, important resource of funding for regional financial growth projects that rejuvenate neighborhoods, create and support tasks, framework, and solutions.

4 Simple Techniques For Eb5 Investment Immigration

Even more than 25 nations, including Australia and the United Kingdom, use similar programs to attract international investments. The American program is much more rigid than several others, needing considerable risk for investors in terms of both their monetary investment and immigration standing.

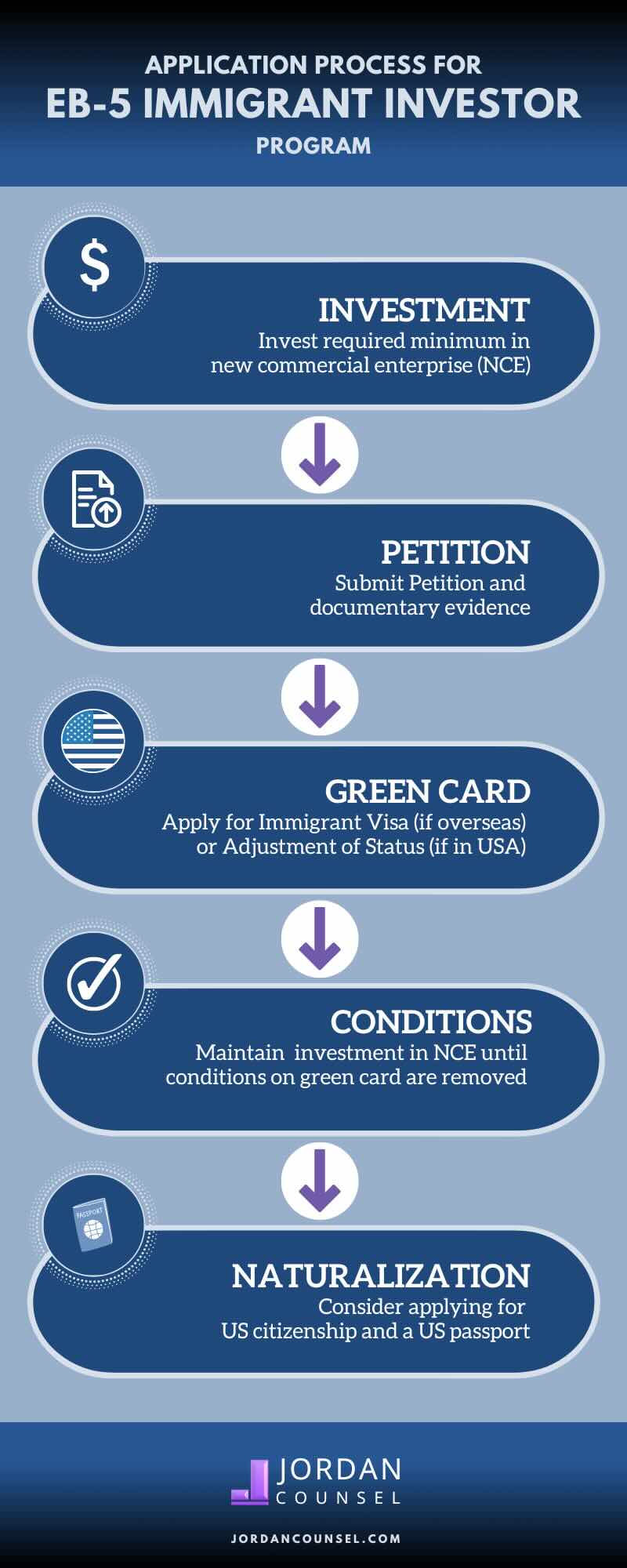

Family members and individuals that seek to move to the United States on an irreversible basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Migration Services (U.S.C.I.S.) set out different needs to get you can find out more long-term residency with the EB-5 visa program.: The initial step is to locate a certifying financial investment opportunity.

As soon as the opportunity has actually been recognized, the investor should make the financial investment and send an I-526 petition to the U.S. Citizenship and Immigration Solutions (USCIS). This application has to consist of evidence of the investment, such as bank statements, purchase contracts, and business strategies. The USCIS will certainly assess the I-526 petition and either authorize it or request extra proof.

Eb5 Investment Immigration Fundamentals Explained

The financier should get conditional residency by sending an I-485 application. This request should be sent within six months of the I-526 authorization and have to include evidence that the financial investment was made which it has produced a minimum of 10 permanent work for united state workers. The USCIS will certainly review the I-485 request and either accept it or request additional evidence.

Report this page